Cloud-Based SACCO Lending Platform

Streamline Your Lending Operations with Automated Loan Processing

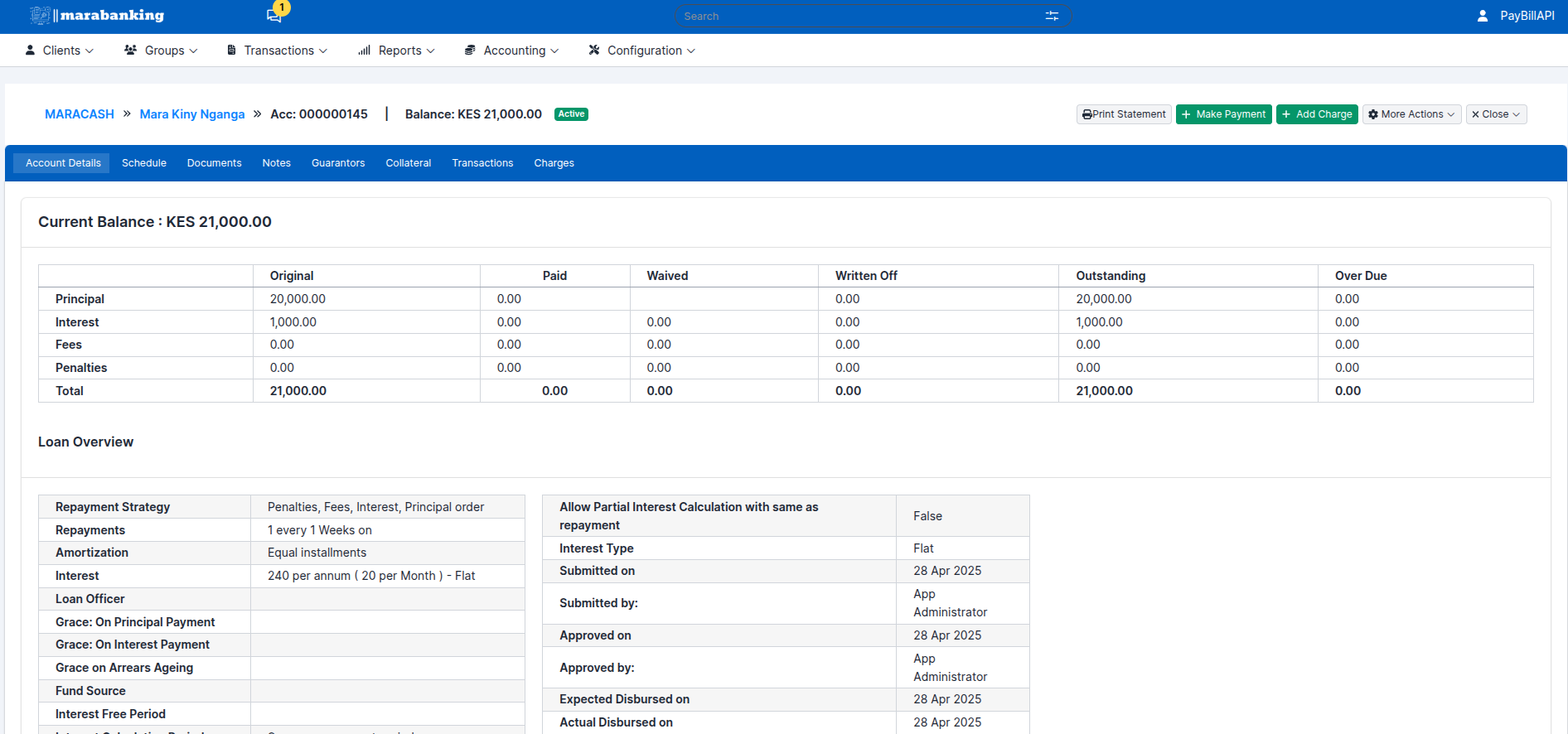

Our digital SACCO lending solution helps you automate the entire loan lifecycle — from application and approval to disbursement and repayment. Offer your members fast, transparent, and affordable credit access anytime, anywhere, through a secure cloud platform built specifically for SACCOs and microfinance institutions.

- ✅ Instant digital loan application and approval

- ✅ Automated interest calculation and repayment schedules

- ✅ Real-time loan performance tracking and reporting

- ✅ Role-based access for credit officers and loan committees

- ✅ Mobile-accessible platform for members and staff

Faster and Better Loan Decisions, Enhanced Conversions, and Lower Costs

Fast Applications

Give your customers a fully digital experience where data is collected, validated, and analyzed in real-time, eliminating tedious manual tasks.

Faster Approvals

Replace time-consuming, paper-based processes with automated and digitized workflows. Our solutions include digitized financial import, income verification, financial spreading, and more.

One platform

Digital Lending supports your digital transformation across all channels and products, including credit cards, personal loans, auto loans, small business loans, and more.

Open API

Our solution comes pre-integrated with best-in-class fintech partners, enabling you to instantly transform and elevate your customer experience.

Easily customizable

No vendor lock-in. No one-size-fits-all approach. Our platform provides all the tools and components you need to build fully digital lending journeys, empowering you to innovate and differentiate in your own unique way.

Loan Application

Digital Lending enables your customers and members to apply for a loan in mere minutes. Say goodbye to tedious paper forms and branch visits with a streamlined, fully automated loan origination experience.

Empowering You Financially

Benefits of Banking and Lending with Cloud Sacco

Competitive Rates: Enjoy some of the most competitive interest rates in the market, both for savings and lending products. We aim to maximize your returns and minimize your borrowing costs.

Flexible Terms: Our banking and lending products come with flexible terms and conditions, allowing you to choose options that best suit your financial situation and goals.

Personalized Service: At Cloud Sacco, we understand that every member is unique. Our dedicated team provides personalized service and financial advice tailored to your specific needs and circumstances.

Community Focus: By banking and borrowing with Cloud Sacco, you contribute to the financial well-being of your community. We reinvest in community development projects, ensuring that your money helps create a better future for all.

Easy Access: Manage your finances effortlessly with our user-friendly online and mobile banking platforms. Access your accounts, apply for loans, and conduct transactions from anywhere, at any time.